Introduction to SPACs

Understanding SPACs with Norwich

Learn about SPACs as a vehicle for listing your company now.

SPACs as a Listing Vehicle

A special purpose acquisition company, or a SPAC. is a publicly traded corporation with a two-to-three-years life span formed with the sole purpose of effecting a merger or combination with a privately held business to enable it to go public. SPACs raise money largely from public-equity investors and have the potential to de-risk and shorten the IPO process for target companies, often offering them better terms and more control over the process than a traditional IPO would.

- "Blank check company" with cash held in trust and no operating business

- SPACs are main board listed companies

- Commitment to merge with the target company within 24 to 36 months of listing

Stakeholders

Sponsor

Investor

Target

Advantages of SPAC over traditional IPOs

Statistics show that in 2023, the U.S. witnessed a total of 98 De-SPAC transactions, from agreement signing to listing completion

AVERAGE DURATION

SHORTEST DURATION

- Strong Listing Certainty

- High efficiency with controllable costs

- Expertise and Strategic Network Resources

Estimated Cost

Need cost estimates for your listing? We can provide you with a comprehensive break down and guide you through the process.

Advantages of the Nasdaq Capital Market

Global Recognition

As of January 31, 2024, Nasdaq is home to 3,439 listed companies with a total market capitalization of $26.26 trillion and total revenues of $8.2 trillion. These leading market figures attract investors worldwide, enhancing the reputation of Nasdaq-listed companies.

Flexible Listing Requirements

Nasdaq's listing requirements are considered more inclusive, making it suitable for innovative business models, smaller companies, and younger enterprises.

Trusted Valuation Benchmarks

Due to Nasdaq's trading volume and scale, its financial benchmarks and valuation standards are globally recognized and trusted.

High Liquidity

Nasdaq is renowned for its high trading volume, with an average daily trading volume exceeding $200 billion.

Refinancing Options

Nasdaq offers a mature market environment where listed companies can leverage various financing tools for refinancing.

Check out our FAQ to find out more.

How do SPACs raise capital?

During the IPO stage, a SPAC company raises funds from public investors. The funds raised are 100% deposited into a trust account and can only be invested conservatively in short-term, low-risk instruments with a focus on capital preservation until the completion of a De-SPAC transaction, generating some returns in the process. The funds held in the trust account are primarily intended for subsequent merger transactions, including redeeming shares of dissenting shareholders in the merger, covering certain underwriting expenses, and serving as operating capital for the post-merger publicly listed company.

If a SPAC fails to complete a merger within the stipulated timeframe, it will face liquidation, and the funds in its trust account, along with any interest accrued, will be returned to investors in full.

In addition to the funds raised during the IPO stage, SPACs often secure additional capital through PIPE investments to meet fundraising needs of the target company before completing the De-SPAC transaction.

How do SPACs select target companies?

The U.S. capital market is highly diverse and inclusive, and companies from traditional industries or emerging sectors, regardless of profitability or revenue generation, can be listed on the U.S. stock market as long as they meet the relevant listing criteria or standards.

The SEC requires SPACs to disclose in their prospectus that they have not identified a target company at the time of their IPO, including that their directors and executives (as well as underwriters or other advisors) have not engaged in any discussions regarding potential target companies.

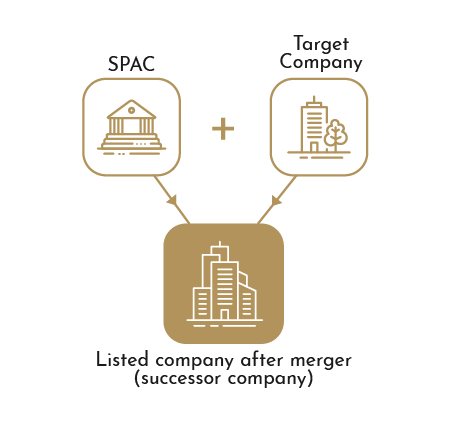

What happens after a target company is acquired by a SPAC?

After the merger is completed, the newly merged company is renamed and officially listed for trading on a U.S. stock exchange. The major shareholders of the original target asset-holding company become the controlling shareholders of the SPAC through equity conversion, while the SPAC sponsors may see their ownership diluted and become minority shareholders and even exit corporate governance bodies such as the board of directors of the listed company.

What are the advantages of SPACs for investors?

- Capital Security

SPACs offer investors a safety mechanism during the IPO phase. All the funds raised in a SPAC IPO are securely placed into a closed trust account, which must be managed by a qualified trustee or custodian and cannot be disbursed arbitrarily.

- Voting Rights

Investors hold voting rights as shareholders in De-SPAC merger transactions. If the merger is not completed within the specified timeframe, the SPAC is liquidated, and the funds in its trust account are returned in full to investors.

- Share Redemption Rights

Following the announcement of the target company, investors with reservations can choose to exercise their redemption rights during the merger vote, reclaiming their principal investment along with any accrued interest.

- Warrant Benefits

When SPACs issue common shares, they simultaneously distribute warrants in corresponding proportions, which can be separated and traded on the first day of SPAC trading, allowing investors to potentially profit from warrant exercise even if they opt to redeem common shares during the merger vote or sell them in the secondary market. This presents investors with an opportunity for improved returns beyond the break-even point.

What are the investment risks associated with SPACs?

From an investor’s perspective, SPAC investments can be divided into two stages. During the SPAC’s listing phase, investors who subscribed to the SPAC’s IPO have the option to exercise redemption rights during the De-SPAC merger vote to reclaim their principal along with interest accrued at the time. For investors who participated in the subscription during this stage, there is generally minimal investment risk until the SPAC completes the merger. However, for investors who acquire SPAC shares on the secondary market, there is a potential to incur losses if their purchase price is higher than the redemption price.

In the post-merger phase of the SPAC, investors who did not exercise redemption rights during the De-SPAC transaction vote become common shareholders of the successor company. Redemption rights are no longer applicable, and their returns or risks will depend on the performance of the successor company in the secondary market.

Investors should avoid blindly following trends when making investment decisions or exercising redemption rights and must conduct thorough due diligence on the target company, including understanding the industry outlook, the company’s core competencies, shareholder background, and future growth expectations.

How is the historical performance of SPACs?

SPACs were first introduced to the U.S. capital market by GKN Securities in 1993, but they did not attract much attention at that time. From 2003 to 2008, the rapid growth of private equity funds and hedge funds, coupled with a unique model that allowed public market investors to participate, gradually gained popularity for SPACs. However, SPACs fell out of favor following the financial crisis of 2008.

In October 2010, the U.S. introduced specific listing standards for SPACs (SPAC 2.0), which required that only public shareholders who voted against a merger transaction could exercise redemption rights, and merger transactions had to secure majority vote approval from SPAC’s public shareholders. During this period, investors had to vote against the merger in order to redeem their shares, which led to a significant number of SPAC mergers failing or being liquidated, greatly increasing the uncertainty of SPAC merger transactions, and SPAC liquidation rates remained high. At the same time, only a handful of SPACs went public. Statistics revealed that in 2010, only 7 SPACs listed on the U.S. market, of which 4 underwent liquidation, resulting in a high liquidation rate of 57%. A mere 9 SPACs were listed in 2012, of which 3 were liquidated. The year 2014 witnessed the listing of only 12 SPACs, of which 4 of them experienced liquidation. The liquidation rates in both 2012 and 2014 stood at 33%. In 2014, Mr. Jason Wong’s team participated in the establishment of the only SPAC in Asia.

After 2015, the U.S. made adjustments to SPAC rules (SPAC 3.0), allowing investors to exercise redemption rights irrespective of their stance on the merger transaction. As a result of these regulatory adjustments, the number of SPACs gradually increased, and SPAC liquidation rates witnessed a substantial decline. At the same time, more companies were willing to go public through SPAC mergers. SPACs ushered in a period of genuine growth. In 2019, a total of 59 SPACs were listed, and after 2020, SPACs experienced an unprecedented surge, surpassing traditional IPOs in terms of both quantity and fundraising scale. This led to 2020 being dubbed the “SPAC Bonanza”.

In 2020, amid the ongoing COVID-19 pandemic and the need for rapid access to capital among numerous companies, combined with the implementation of loose monetary policies in the U.S., the advantages of SPACs, such as strong listing certainty, accelerated timeline, and controllable risks, became prominent. SPACs began to experience a boom.

Statistics show that in 2020, there were 248 SPAC IPOs, accounting for 52.7% of all U.S. IPOs that year and raising approximately $83.3 billion, representing 53.5% of total U.S. IPO fundraising. For the first time, SPACS outpaced the traditional IPO model. In 2021, a staggering 613 SPAC IPOs took place, collectively raising $162.5 billion.

However, in 2022, the U.S. SPAC market faced challenges due to the persistent impact of the COVID-19 pandemic, geopolitical instability, and the Federal Reserve’s decision to tighten monetary policy and reduce its balance sheet. This resulted in a sharp decline in both traditional IPOs and SPAC IPOs. Despite these hurdles, SPAC IPOs still accounted for 40% of total IPO numbers and 61% of total fundraising amounts in the U.S. In essence, SPACs have established themselves as a viable listing option alongside traditional IPOs.

How is the global development trend of SPACs?

Although SPACs have been present in the U.S. since the 1990s, they have not been a mainstream source of IPO financing. However, in 2020, SPACs burst onto the scene, catalyzed by factors like the pandemic, and became a focal point in the market. A total of 248 SPACs completed listings and began searching for target companies. In 2021, there was a boom in SPACs, with an astounding 613 SPACs successfully listing. SPACs have secured a preliminary position in the capital market, and even in 2022, despite a decrease in the number of SPAC IPOs, they continue to be a viable option for companies to go public, thanks to their unique advantages. Currently, the U.S. is the preferred IPO destination for SPACs, but with the entry of other countries like Singapore, Japan, South Korea, and Hong Kong, competition in the international SPAC market will intensify. To gain an edge in this competition, each country may adopt differentiated regulatory rules to strike a balance between attracting SPAC listings and protecting investor interests. These differentiated regulatory rules will collectively shape a comprehensive and mature international SPAC market system, fostering the continued healthy and orderly development of capital markets.

The Difference Between U.S. SPACs and Hong Kong SPACs

To begin with, SPAC mergers for listing must adhere to similar IPO standards. In terms of listing requirements, the U.S. boasts a multi-tiered capital market with relatively flexible listing eligibility criteria. Companies that meet the relevant conditions, even those that have not yet turned a profit or generated revenue, can still embark on the path to public listing. Conversely, Hong Kong’s main board sets higher listing requirements. If a company fails to meet the profitability benchmark, the other two tests impose an additional criterion of revenue exceeding HK$500 million. Consequently, emerging technology firms that have not reached profitability or have modest revenue streams find it challenging to meet Hong Kong’s main board listing prerequisites, and as a result, cannot merge with Hong Kong SPACs (although emerging biotechnology companies that are not yet profitable or revenue-generating can explore the Chapter 18A listing rules to go public in Hong Kong through the SPAC listing route).

Over the past two years, U.S. SPACs have emerged as a leading listing model, effectively competing with traditional IPOs. Hong Kong, on the other hand, positions itself as a market where SPACs helmed by experienced, reputable promoters committed to identifying high-quality merger targets can list. Hong Kong emphasizes on upholding the quality of its capital markets and protecting investor interests, and has formulated more stringent SPAC listing rules to this end, including prerequisites for SPAC promoters to be licensed institutions under the Hong Kong Securities and Futures Commission, restrictions on the subscription and trading of SPAC securities to professional investors exclusively, mandatory appointment of independent financial advisers, and stipulation of compulsory investment ratios by third-party investors (PIPE). In essence, Hong Kong’s SPAC listing requirements are more stringent and are best suited for relatively mature emerging technology companies with substantial revenue streams.